Self-Managed Investment Portal

Fiduciaria Sura, one of Colombia’s largest investment firms, offers a diverse portfolio of 27 funds and over $140M in assets under management. Despite its strong market presence, its investment management process remained highly traditional, relying on phone calls, physical signatures, and commercial executives to execute user transactions.

The lack of digital self-management tools created frustration among investors, leading to high support dependency and a decline in user retention. To address this, we designed a self-service investment portal that would provide users with full control over their portfolios, real-time access to balances and transactions, and the ability to make partial or total withdrawals autonomously.

Company

Sura

Date

September 2021

Role

UX / UI Designer

Team

PMs, Dev

Platform

Web, Responsive

Background

Fiduciary investment platforms are often tied to outdated, manual processes, making them inaccessible for users accustomed to digital banking and investment tools. The barriers to managing investments in Sura Fiduciaria included:

Limited access due to business hours – Users could only make transactions during specific hours.

Time-consuming processes – Phone calls, paperwork, and physical signatures were required for simple actions.

Lack of real-time control – Users felt disconnected from their investments, leading some to withdraw funds in search of more flexible alternatives.

The pandemic further exposed these inefficiencies, increasing user demand for digital autonomy in investment management.

Opportunity & Strategy

Enable users to self-manage their investments in a secure and intuitive way.

To reduce friction and enhance user retention, we created a centralized investment portal where users could:

Monitor balances and movements in real time

Execute withdrawals in a fully digital process

Navigate an intuitive, user-friendly interface that aligns with financial mental models

By digitizing investment management, we aimed to increase retention and position Sura Fiduciaria as a modern, user-centric financial platform.

Research & Methodology

📍

Information Architecture & Navigability

Developed a clear and intuitive structure, ensuring a low learning curve while maintaining familiarity with traditional financial platforms.

🎯

User interviews

Conducted 9 in-depth interviews with long-time Fiduciaria Sura investors, uncovering pain points in the manual processes and lack of real-time access.

Confirmed that the current process was highly frustrating, reinforcing the need for a self-management solution.

🔍

Competitive benchmarking

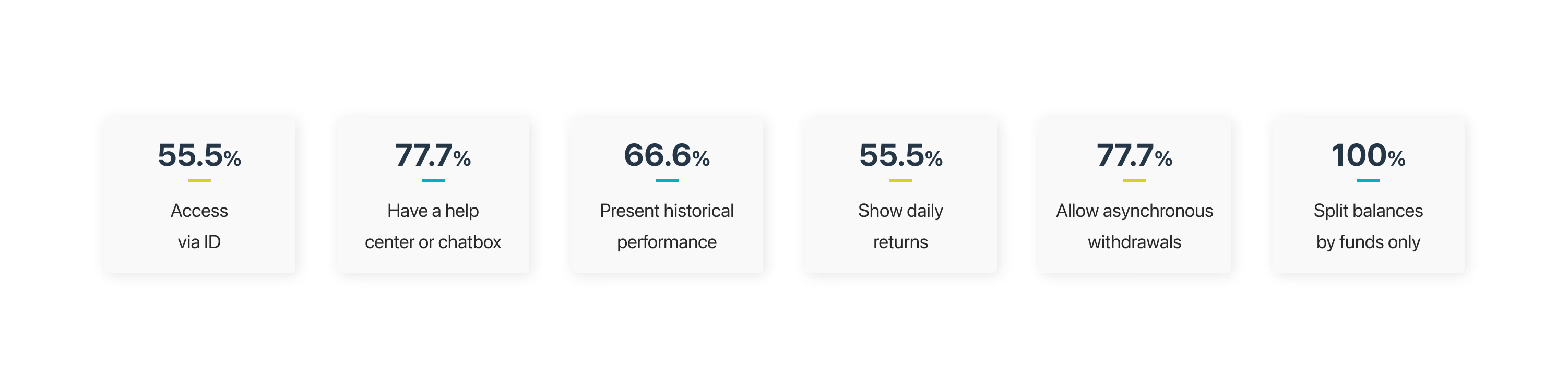

Analyzed leading investment platforms to identify best practices in self-service tools, security, and navigation patterns.

Structure - Product navigability

With a clear objective and user insights, we generate a simple information structure that would allow users to navigate and reduce the learning curve with this new product, in addition to recreating the financial experience as similar as possible to traditional portals with those who have contact in their day to day.

Ideation - Design system

Taking as a starting point a graphic identity of the brand and a UI kit, we generated a design system with components that would allow us to create a scalable product and, above all, accessible to our users.

A Fully Digital Self-Management Platform

Secure & Seamless Access

Security was a primary concern, given the high-value transactions handled by the platform. To build user trust, we implemented:

Two-factor authentication for first-time logins.

Transparent security messaging to reinforce confidence in the system.

Fund Details & Portfolio Management

Frictionless Withdrawals in 3 Steps

We designed a 3-step withdrawal process that allowed users to:

Select the specific order they want to withdraw from

Enter the amount & receive immediate viability feedback

Review potential penalties & confirm the transaction

This transparency ensured users made informed financial decisions, minimizing errors and frustration.

Transaction History & Performance Insights

Users needed visibility into past transactions and earnings. To support this, we developed:

Historical transaction logs with filtering by date, transaction type, and specific funds.

Profit tracking within custom timeframes.

Onboarding & Error Prevention

Since self-management was a new concept for Fiduciaria Sura’s customers, we introduced:

An interactive onboarding process to guide users through key functionalities.

Real-time alerts and notifications to prevent errors and enhance transparency.